Agenda

Agenda

10 December

2025Welcome to AI & Fintech Abu Dhabi

Kick off a dynamic programme exploring the technologies, trends and breakthroughs transforming finance and intelligence. This welcome sets the tone for a week where innovation meets impact, and where Abu Dhabi takes centre stage in shaping the future.

H.E. Hamad Sayah Al Mazrouei

Undersecretary of the Department of Economic Development Abu Dhabi & Chairman

ADGM Academy

Innovating Beyond Boundaries: Lessons from Netflix’s Disruption

Marc Randolph, co-founder and first CEO of Netflix, draws on his experience with this megabrand. From transforming entertainment through a then revolutionary subscription payments model, to exploring how disruptive innovation can reshape financial markets. He shares insights on embracing change, scaling new business models and influencing customer behaviour in today's rapidly changing world.

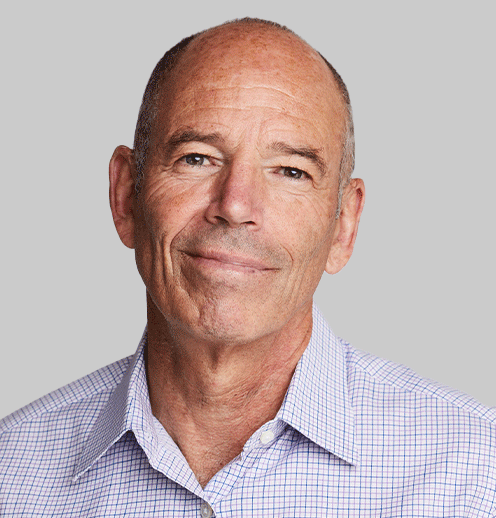

Marc Randolph

Former CEO & Co-Founder

Netflix

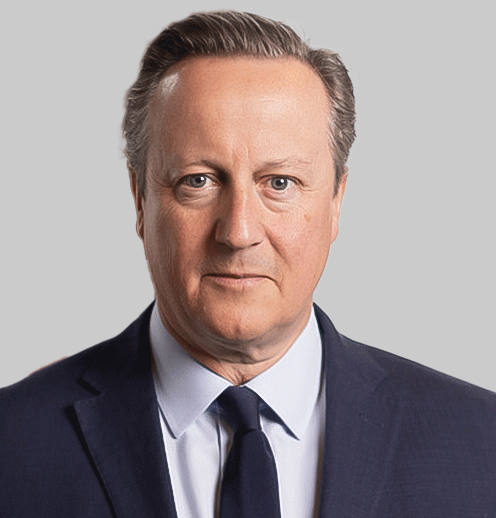

Leading Through Disruption: In Conversation with Lord David Cameron

A confidential fireside interview with one of the world’s most influential AI investors, exploring how advanced architectures are reshaping value creation, productivity and global competitiveness. In discussion with CNBC, this session delves into what’s driving the next wave of breakthroughs—and what leaders should prepare for as intelligence becomes an embedded layer across every industry.

Lord David Cameron

The Rt Hon the Lord Cameron

Former Prime Minister of the United Kingdom

Hadley Gamble [Moderator]

Chief International Anchor

IMI

Agentic AI: Powering Instant Intelligence

Now the driver powering instant intelligence, Agentic AI offers autonomous, real-time decision-making that revolutionises fraud detection, risk management and customer personalisation. In this panel discover how self-driven AI systems can accelerate financial processes, cut through complexity and deliver smarter, faster outcomes. Transforming the future of digital finance right before our eyes.

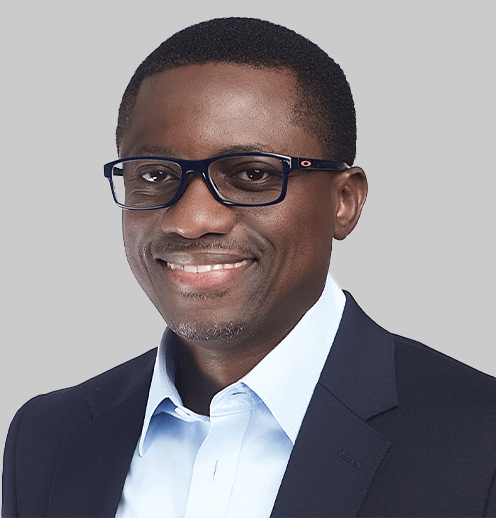

Otto Williams

SVP, PayPal World

Regional Head and GM, Middle East and Africa, PayPal

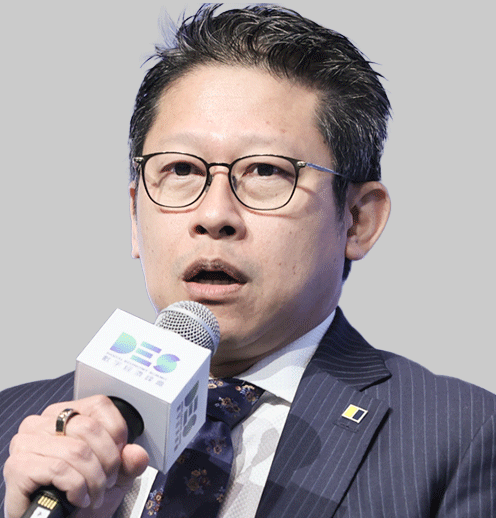

Thomas Pramotedham

CEO

Presight

Godfrey Sullivan

SVP Products & Solutions, CEMEA

Visa Middle East

Louay Abou Chanab

Group Chief Digital & AI Officer

ADQ

Liz Hoffman [Moderator]

Business & Finance Editor

Semafor

The Intelligence Economy: What Happens When AI Gets Real

In this session two of the sharpest minds at the frontier of machine intelligence explore what’s next. From building the infrastructure that powers foundation models, creating digital workers and applying scientific insight at scale, this fireside goes deep on how AI is remaking decision-making, risk and value creation across industries. What happens when AI stops being a tool and instead, starts becoming the environment?

William Stone

Chairman & CEO

SS&C Technologies

David Siegel

Co-Founder & Co-Chairman

Two Sigma

Eugene Tang [Moderator]

Managing Editor

South China Morning Post

Conviction & Code: Utilising Foundational Frameworks to Build New Economic Ecosystems

As artificial intelligence moves from experimental to essential, its impact on global economic systems is being shaped by more than just innovation, it’s being guided by conviction, control and long-term vision. In this session, investment leaders, AI pioneers and governance architects explore how trusted infrastructure, ethical frameworks, and strategic alignment are driving the next era of financial and technological growth. From national strategies to corporate execution, this is where foundational decisions are made.

Ashish Koshy

CEO

Inception (a G42 company)

Trevor Thompson

Managing Director - Global

Scale AI

Aidan Millar

Head of AI Enablement

Mubadala Investment Company

Lake Dai

Founder & Managing Partner, Sancus Ventures

Adjunct Professor, Carnegie Mellon University

Mohammed Sergie [Moderator]

Editor

Semafor

The Sovereign Rails of Tomorrow: ADI Reveals the Infrastructure Powering the UAE’s Web3 Economy

At ADFW 2024 Huy Nguyentrieu announced the launch of ADI Foundation, created to connect 1 billion people—especially across the Middle East, Africa, and Asia—to trusted blockchain infrastructure. One year on, Ajay Bhatia reflects on ADI’s progress: the successful ADI Chain testnet, its imminent mainnet launch, and the key milestones and partnerships across TradFi and DeFi that aim to deliver real-world impact for governments, enterprises, and citizens.

Ajay Hans Raj Bhatia

CEO

Sirius International Holding

The Tech-onomic Forecast: Top Digital Shifts You Can’t Ignore

Stay ahead of the curve with a deep dive into the top digital transformation trends set to redefine the world of finance and banking. From AI-driven automation to the rise of decentralized finance, this session reveals the game-changing shifts every business leader needs to understand to thrive in tomorrow’s financial landscape.

Maurice Gravier

Group Chief Investment Officer

Emirates NBD PJSC

Building the Future of Finance: The UAE’s Fintech Success

The UAE is building the future of finance through progressive regulation and future-proofing financial market infrastructure. Join this session to hear the concise view from the Central Bank on how the UAE is enabling innovation and positioning itself as a leading global hub for fintech.

Paul Kayrouz

Chief Fintech Officer

Central Bank of the UAE

Crypto’s Moment of Truth: Boom, Bridge or Build?

The wild ride of crypto has minted fortunes and shaken reputations but can it ever shake off the turbulence? This unfiltered fireside tackles the hard questions: is real utility finally emerging, or are we still chasing speculative ghosts? Who wins the battle for trust: exchanges, institutions or regulators? Expect sharp views, strong disagreements, and a clear-eyed look at whether crypto survives, or thrives, in its next chapter.

Richard Teng

Co-CEO

Binance

Lawrence Wintermeyer [Moderator]

Chair

Global Digital Finance

The Internet Financial System: A New Architecture for the Global Economy

The age of analog finance is over. Join Circle Cofounder, CEO, and Chairman Jeremy Allaire as he lays out a vision for the rapid rise of the Internet Financial System—a real-time, borderless, and programmable layer for economic value exchange.

Jeremy Allaire

Co-Founder, Chairman & CEO

Circle

Digital Credit: Harnessing Superior Yield through Bitcoin

As legacy financial systems face disruption, digital credit infrastructure is fast becoming the foundation for a new economic paradigm. In this keynote, Strategy’s Michael Saylor explores how decentralised technologies, institutional-grade assets and a shift in monetary thinking are transforming the future of credit, liquidity and long-term value.

Michael Saylor

Founder & Executive Chairman

Strategy

The Great Convergence: The Infrastructure Race for Tomorrow’s Markets

As financial markets undergo radical transformation, the lines between traditional infrastructure and next-generation platforms are blurring. This conversation explores the convergence of old and new, from settlement rails to tokenization protocols and what it takes to build trust, scale and resilience into the financial architecture of tomorrow. With global capital, regulation, and innovation pulling in different directions, who will shape the foundations of the next era?

Brian Armstrong

Co-Founder & CEO

Coinbase

Anthony Scaramucci [Moderator]

Founder & Managing Partner

SkyBridge Capital

In Conversation with Solmate

A three-step plan to overthrow Wall Street and rebuild a faster, cheaper and fairer version here in the UAE.

Marco Santori

CEO

Solmate

Lily Liu [Moderator]

President

Solana Foundation

Gulf Economic Update Presented by the World Bank

The GEU is a World Bank publication focusing on the GCC countries. It analyzes recent macroeconomic trends while placing them within regional and global contexts, and presents medium-term projections for all GCC economies. It also takes stock of the progress on diversification over the last decade, focusing on economic activity, fiscal and export diversification to illustrate how effectively they are reducing their dependence on hydrocarbons.

Unlocking the Next Chapter in Global Money Flow

As billions move across borders daily, the rails and rules underpinning those flows are evolving fast. In this session, leaders from institutional infrastructure, retail platforms and global remittance networks unpack how payments innovation is transforming access, efficiency and inclusion across both emerging and developed markets. From building trust across fragmented jurisdictions to scaling digital-first models at speed, this is a grounded, real-world look at the breakthroughs reshaping how money moves and where the next leap will come from.

Anthony Soohoo

Chairman & CEO

MoneyGram

Humphrey Valenbreder

CEO

Partior

Dr. Tariq Bin Hendi

CEO & Board Member

Astra Tech - Botim

Jayesh Patel

CEO

Wio Bank PJSC

Gina Clarke [Moderator]

Content Director, Fintech Abu Dhabi

Abu Dhabi Finance Week

Modernising the Machine: Inside the Transformation of Traditional Banking

What does transformation really look like inside a traditional financial institution? In this candid discussion, learn how banks are rewiring operations, digitising at scale and preparing for a future shaped by AI, tokenisation and rising client expectations. Beyond buzzwords, they’ll explore what’s working, what’s breaking and how institutions with legacy weight are turning it into competitive advantage in a market that demands constant reinvention.

Mostapha Tahiri

EVP & COO

State Street

Jamal Al Awadhi

CEO

Al Hilal Bank

Christos Megalou

CEO

Piraeus Group

Emily Sheffield [Moderator]

Founder

Dartmouth55 Advisory

Vision, Volatility, and Velocity: What Fintech CEOs Are Betting On Next

From reimagining credit to redefining digital banking, today’s fintech leaders are navigating a market that demands speed, trust and bold moves. In this high-level discussion, growth focused CEOs unpack what’s on their radar: regulation, profitability, AI, customer trust and what they’d do differently if starting again. Candid, future-focused and unapologetically ambitious, this is a conversation about what it really takes to lead in fintech’s next chapter.

Ambareen Musa

CEO, GCC

Revolut

Tarik Chebib

MENA CEO

Capital.com

Kiet Tran

CEO

Lukka

Eugene Tang [Moderator]

Managing Editor

South China Morning Post

Bank 3.0

Hanwha is building an on‑chain banking model with Nobu Bank in Indonesia to reshape how value lives, moves, and settles across blockchain networks. By combining Hanwha’s global traditional and on chain capabilities with open partnerships, Nobu is positioned to become a leading on chain bank and a launchpad for a more inclusive, collaborative global financial ecosystem.

Don Kim

Chief Global Business Officer

Hanwha Life

Champions of the Falcon Economy

This special segment will showcase the investment thesis and growth strategies of several listed industrial champions as they shape Abu Dhabi’s economic future.

Andrew Cole

CFO

Space42

Munaf Ali

Co-Founder & CEO

Phoenix Group

Ram Meyoor

CFO

Presight AI

Beyond OTPs: Building Trust in a Device-First, Authentication Future

Financial institutions worldwide are moving away from SMS and email OTPs. Why? They are easily stolen through phishing, SIM swaps and malware, and they frustrate customers with friction and delays. To truly safeguard digital banking, institutions must embed device fingerprints, behavioral biometrics and advanced analytics. Whether mandated by regulation or adopted proactively, the case is the same: authentication must be device-bound, behaviour-aware and analytics-driven. This session explores how to prepare for what comes next.

Soups Ranjan

CEO

Sardine

The Unicorn Formula: Funding Winners Before the World Notices

What does it really take to back a billion-dollar company before the crowd catches on? In this candid fireside, hear from several of the most active early-stage investors on the planet as they share the signals they trust, the bets that paid off and what’s changed in the hunt for outliers. From instinct to data, pricing to patience, this is the unfiltered playbook behind building a unicorn portfolio.

Jose Marin

Co-Founder & Managing Partner

FJ Labs

Brad Levy [Moderator]

CEO

Symphony

The Power of the Crowd: How AI and Social Are Reshaping Retail Investing

AI tools, open marketplaces and public API's are empowering a global community to build and share their own investing tools. By combining the collective intelligence of millions of users with cutting-edge AI, social investing can become a true engine for innovation in retail finance. Find out more in this keynote, featuring real-life use cases.

Yoni Assia

Co-Founder & CEO

eToro

Digital Desire: How Tokenizing Luxury Can Lead to New Ownership Models

Luxury is no longer limited to physical goods, instead it's algorithmic, tokenized and increasingly hyper-personalized. From fractional real estate to fashion NFTs and AI-curated brand experiences, this fireside explores how emerging tech is redefining exclusivity and ownership. With one foot in the tangible world and the other in digital ecosystems, today’s innovators are using AI and tokenization not just to sell, but to elevate status, shape identity and create scarcity in infinite digital spaces.

Amira Hussain Sajwani

Managing Director, DAMAC Group and Founder & CEO

PRYPCO

Snow Feinan Li [Moderator]

Chair of SABA Investment, Vice Chair of QingSong Capital & Vice Chair

MT Group

The Global CMO: Growth, Governance and Getting It Right in New Markets

For CMOs at global financial platforms, entering new markets isn’t just a launch plan, it’s a regulatory, cultural and reputational minefield. This conversation brings together marketing leaders to explore the tightrope between ambition and accountability. How do you localise without diluting? Where does marketing intersect with legal and compliance? And what does it take to earn trust in regions where your brand is unknown, or perhaps misunderstood?

Rachel Conlan

CMO

Binance

Dave King

CEO

Digitalis

Darius Alexander [Moderator]

Managing Director

FTI Consulting

Invisible Payments, Visible Growth: Under the Hood of Today's Power Plays

From challenger banks to cloud-native scaleups, the financial stack behind global innovation is undergoing a quiet revolution. This panel brings together four bold operators rewriting the rules, from startup banking built for tomorrow’s tech giants, to payments platforms going global from east to west and infrastructure players taking on the hyperscalers. Together, they’ll explore what it takes to fuel the next wave of growth, asking who’s really holding the keys to the future of fintech?

Hosam Arab

CEO & Co-Founder

Tabby

Ben Zhou

CEO & Co Founder

Bybit

Mark Rydquist

Managing Director

Gina Clarke [Moderator]

Content Director, Fintech Abu Dhabi

Abu Dhabi Finance Week

From Islands to Infrastructure: Borderless Financial Services

Fragmented systems, national platforms and closed-loop architectures have long defined the financial world, but that’s changing fast. As regulators, fintechs and infrastructure builders converge, the push for interoperability, real-time access, and shared standards is reshaping how money moves. This session brings together leaders to explore what it takes to build a truly connected financial future and who sets the rules when money moves across systems, sectors and borders.

Kaan Terzioglu

Group CEO

Veon Group

Barry ODonohoe

CEO

Raidiam

Murat Suzer

CEO

Network International LLC

Vibhor Mundhada

CEO

NEOPAY

Patricia Wu [Moderator]

Anchor

Fintech TV

(Re)Insurance (Re)Imagined: Navigating Climate Risk, AI and Market Volatility

This high-level conversation explores how the reinsurance sector is evolving in response to mounting climate risks, AI-powered modeling innovations and fluctuating capital markets. Industry leaders discuss strategies for building resilience, leveraging technology to enhance risk assessment and adapting to a rapidly changing financial landscape to safeguard the future of global insurance.

Andreas Berger

Group CEO

Swiss Re

Mark Wilson

CEO, RIQ

Board Member, Blackrock

Afroditi Boura [Moderator]

Founding Member and Director

Association of Reinsurance (ADGM) Limited

The MENA Fintech Awards

The MENA Fintech Awards celebrate the region’s most innovative and impactful fintech companies, entrepreneurs, and leaders. Recognizing excellence across categories like payments, digital banking and new technologies, the awards highlight the breakthroughs driving financial inclusion and technological transformation across the Middle East and North Africa.

Nameer Khan

Chairman

MENA Fintech Association

Welcome to RESOLVE - Abu Dhabi International Dispute Resolution Forum

Please stay tuned for more details about this session soon.

Rachel Pether

Head of MENA

3iQ

Linda Fitz-Alan

Registrar & Chief Executive

ADGM Courts

Justice with Courage: The UAE’s Path to Legal Leadership

In times of uncertainty, it takes courage to lead and set the standard. In this keynote, His Excellency will reflect on how the UAE’s judiciary is confronting the disputes of tomorrow, whether they arise from technology, commerce, or shifting global dynamics. By weaving innovation into the fabric of justice, the nation is building a system that commands confidence, protects fairness, and ensures the rule of law continues to guide society through uncharted territory.

H.E. Abdullah bin Sultan bin Awad Al Nuaimi

Minister of Justice

Government of the UAE

That Will Never Work: In Conversation with Marc Randolph

This conversation traces the quiet persistence and bold choices behind building a global disruptor. Through moments of doubt, reinvention, and unlikely success, it offers a window into the mindset required to embrace uncertainty. For leaders in law and business, it’s a gentle reminder that the ideas most worth pursuing are often the ones others dismiss too quickly.

Marc Randolph

Former CEO & Co-Founder

Netflix

Essam Al Tamimi [Moderator]

Chairman

Al Tamimi & Co

AI Reckonings: Risk, Rights & Resolution

As generative AI reshapes how business operates, it’s also accelerating threats. Cyberattacks have surged with phishing alone spiking over 1200% in one year. This panel will examine the mounting dispute resolution challenges triggered by AI, from liability in algorithmic decisions to accountability in AI-enabled breaches. With global regulators struggling to keep pace, what role must the legal community play in shaping safeguards, enforcement tools, and ethical frameworks before the next crisis strikes?

Donya Fredj

Deputy General Counsel

G42

Magdalena Konig

General Counsel

AIQ

Danny Tobey

Partner

DLA Piper

Minesh Tanna

Partner & Global AI Lead

Simmons & Simmons

Graham Lovett [Moderator]

Partner

Akin Gump, Strauss, Hauer & Feld LLP

Coffee & Networking

Are You Ready for The Cyborgs?

Dr. Nancy W. Gleason will explore how individuals and institutions can remain future-ready in times of disruption. Drawing from her work on education, policy, workforce development and emerging neuroscience including brain-computer interfaces, she will examine how systems can foster critical thinking, adaptability and inclusion. This talk highlights the courage required to rethink legacy models in law, leadership and learning. It invites attendees to reflect on what true preparedness means for the unpredictable decades ahead.

Nancy Gleason

Professor

MBZUAI

Code, Currency, and Courts: Unravelling a Cross-Border Crypto Dispute

This session dissects a real-world cross-border crypto dispute, tracing a tokenised asset across jurisdictions and unpacking the legal fallout when the transaction unravels. As DeFi and digital assets transcend borders, courts face tough questions: Which law applies? Who has jurisdiction? Can crypto be frozen? Can judgments be enforced on-chain? Conflicting regulations further complicate enforcement. A dynamic panel of counsel, regulators, and industry insiders will walk through a multi-jurisdictional case, exposing procedural hurdles, clashing legal frameworks, and the urgent need for legal clarity in an unbounded digital economy.

Andrej Majcen

Group CEO

Bitcoin Suisse Group

Wai Lum Kwok

Senior Executive Director

ADGM FSRA

Irina Heaver

The Crypto Lawyer

NeosLegal

Kate Jackson-McGill

Partner

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

Prof. Sarah Green [Moderator]

Professor of Private Law, University of Bristol & Independent Arbitrator

Newmans Row

Lunch & Networking

The Edge: Strategy, Pressure, Negotiation

In a world of relentless demands and razor-thin margins, how do top performers make decisions under pressure? This spotlight session explores the intersection of mental clarity, strategic negotiation, and sustained high performance. Blending behavioural science, leadership insight, and real-world tactics, our speaker reveals how to stay sharp when the stakes are highest, and how to turn negotiation into a performance edge, not a pressure point. For leaders, lawyers, and strategists - this is performance redefined.

Matthew James Lewis

Managing Director

Hintsa Performance

Risk & Regulation: A CEO’s Playbook

What are the unresolved threats that top CEOs are quietly preparing for? This session brings together senior business minds to explore the high-consequence disputes facing today’s corporate leaders - from ESG litigation and shareholder activism to cyber breaches, geopolitical backlash, sudden enforcement sweeps and more. How are leadership teams aligning their legal strategy with boardroom priorities? What does effective pre-litigation risk management really look like when reputation and regulation collide?

Richard Teng

Co-CEO

Binance

William Stone

Chairman & CEO

SS&C Technologies

Rola Abu Manneh

CEO, UAE, Middle East and Pakistan

Standard Chartered Bank

Andreas Berger

Group CEO

Swiss Re

Paula Fontenla

Founder

Argentem Creek Partners

Sherrese Smith [Moderator]

Global Managing Partner

Paul Hastings

Haider Rafique

Managing Partner and CMO

OKX

Marcel Kasumovich [Moderator]

Founder

Pure Macro Advisors

Bullish for Builders: Is 2026 the Year the Foundations Hold?

This isn’t just another crypto panel. It’s a pulse check from insiders who have built empires, weathered cycles and called the market before it moved. With decades of combined foresight across blockchain, trading and innovation, this conversation brings together some of the most influential and at times controversial voices in digital assets. From market resilience to next-gen adoption, they will unpack what’s real, what’s noise and why the bets they are placing now could shape everything in 2026.

Mike Novogratz

Founder & CEO

Galaxy

Joseph Lubin

Founder & CEO

Consensys

Reeve Collins

Co-Founder & Chairman

STBL | WeFi, Incoming Chairman, ReserveOne

Georgia Tolley [Moderator]

Presenter

Dubai Eye 103.8 FM

The Long Game: Rebuilding Trust in Global Finance with Decentralized Infrastructure

As volatility, fragmentation and regulatory overcorrection redefine the post-crisis landscape, this keynote unpacks how decentralized infrastructure is quietly becoming the backbone of tomorrow’s financial system. From settlement and custody to sovereign stablecoins and programmable assets, trust is no longer built by institution, but by design.

Charles Hoskinson

CEO & Founder

Input | Output

Public Chains, Public Gains: Blockchain for a Better Society

From protecting medical records to streamlining public finance, blockchain is gaining ground as a transformative tool for governments. In this session, we explore how decentralised infrastructure is being used to improve access, transparency, and trust across sectors, from healthcare to identity to social services. As civic applications move beyond theory into practice, we ask: can blockchain unlock more inclusive, citizen-centric systems? And what will it take for these innovations to scale safely, securely, and for public good?

Huy Nguyen Trieu

Co-Founder, CFTE & Council Member

ADI Foundation

Rauda Al Dhaheri [Moderator]

Head of ADGMA Research and Development

ADGMA Research Centre

Privacy at Scale: Evolving Digital Assets for the Future Economy

As regulation tightens and adoption widens from on-chains to stablecoins, it's important to build resilience across compliance, privacy and infrastructure. Join industry leaders to explore how to scale securely, serve millions and remain adaptable in a fast-moving market. Can privacy and compliance coexist? What does platform resilience really mean and which players are truly ready for what comes next?

Simone Maini

CEO

Elliptic

Azeem Khan

Co-Founder

Miden

Fahmi Syed

President

Midnight Foundation

Mike Reed

SVP/Head of Digital Asset Partnership Development

Franklin Templeton

Emma Joyce [Moderator]

Chief Revenue Officer

Global Blockchain Business Council

Collateral Infrastructure: Building the Rails for Tokenized Leverage

From tokenized funds to next-gen lending protocols, unlocking crypto collateral is becoming a key frontier for institutional adoption. This panel brings together leaders to explore how tokenized assets, DeFi infrastructure, and regulated trading venues are reshaping capital efficiency. What guardrails are needed? What’s stopping institutions from tapping into this value? And how close are we to real interoperability between crypto-native and traditional collateral systems?

Redwan Meslem

Executive Director

Enterprise Ethereum Alliance

Sabrina Wilson

COO

GFO-X

Andrej Majcen

Group CEO

Bitcoin Suisse Group

Helen Ye

CEO

Qubit Underwriting Ltd.

Melvin Deng [Moderator]

CEO

QCP

High Speed Horizons: Speed and Scalability Converge

The next evolution in global finance is Internet Capital Markets — a single global marketplace for every tradeable asset, operating at the same scale the internet does for information. Hear from one of the industries most prominent figures about the way blockchain technology is transforming the future of finance, the real-world use cases live today, the technical breakthroughs making them possible, and his vision for a future where markets are open, instant, and accessible to anyone, anywhere.

Anatoly Yakovenko

Co-Founder, Solana

CEO, Solana Labs

Anthony Scaramucci [Moderator]

Founder & Managing Partner

SkyBridge Capital

Solving Trust and Liquidity Challenges in Digital Asset Markets

With an increased digital assets market, liquidity and trust remain key drivers of institutional confidence and market scalability. This session explores how transparency, security measures and evolving infrastructure come together to create resilient, efficient markets. Experts will discuss how these foundations enable sustainable growth and foster wider adoption of digital finance.

Amar Kuchinad

CEO

Copper Technologies

Michael Higgins

International CEO

Hidden Road

Bouchra Darwazah

Managing Director, Principal Trading

Galaxy

Martina Fuchs [Moderator]

Business Journalist

Xinhua

From Access to Allocation: How Institutions Are Scaling Digital Asset Portfolios

As institutional exposure to digital assets deepens the challenge is no longer just access, it's allocation. This session brings together leaders from asset management, crypto-native funds and infrastructure to explore how multi-fund strategies are evolving to meet the needs of institutional investors. From managing volatility and regulatory complexity to scaling across fund structures and custody models, the conversation will unpack how institutions are building diversified, defensible crypto portfolios for the long term.

Chris Rayner-Cook

CIO

Brevan Howard Digital

Tony Ashraf

Managing Director

BlackRock

Rayhaneh Sharif-Askary

Head of Product and Research

Grayscale Investments

Evy Theunis

Head of Digital Assets

DBS Bank

Henri Arslanian [Moderator]

Co-Founder

Nine Blocks Capital Management

Keeping the FlyWheel Spinning: How Legacy Finance is Fuelling Next-Gen Products

Dive into how financial giants are taking the best of their legacy strength and blending it with cutting-edge DLT magic. We’ll explore how lessons from the blockchain gaming world are reshaping payment innovations, how ventures are backing the next wave of embedded finance, and how trends from East to West are shaping the future. See how established players are not just keeping pace but setting the tempo for the next generation of financial products.

Yasmina Kazitani

President

Blockchain Game Alliance

Tatsuya Yamada

President

Rakuten Wallet, Inc.

Baek Kyoum Kim

General Partner

Hashed

Ambre Soubiran

CEO

Kaiko

Konstantinos Adamos [Moderator]

Group Head of Legal and Compliance (Crypto)

Revolut

Programmable Yield: Building the Next Market for Tokenised Debt

Debt markets are being reimagined on-chain. From tokenised treasuries to programmable fixed-income products, the infrastructure is emerging to create a new category of digital assets: scalable, transparent, and globally accessible debt instruments. As legacy systems converge with blockchain rails, the question is no longer when – but how fast institutions will adopt this new model.

Brett Tejpaul

Head of Institutional

Coinbase

Patrick O'Meara

Chairman & CEO

Inveniam Capital Partners

Mark Hull

Contributor

Kamino Foundation

Oya Celiktemur

EMEA Director

Ondo Finance

Marcel Kasumovich [Moderator]

Founder

Pure Macro Advisors

Stablecoins in the Balance: Navigating Trust and Scale

Stablecoins are edging closer to the core of global finance but questions of trust and scale remain unresolved. This session brings together key players from both traditional finance and blockchain infrastructure to explore what it takes to operationalise stablecoins in a regulated environment. From settlement speed to regulatory clarity, the conversation focuses on the roadblocks that remain and the partnerships emerging to overcome them.

Michael Chan

CEO

Zand

Bob Diamond

Co-Founder & CEO

Atlas Merchant Capital

Julian Sawyer

CEO

Zodia Custody

Marco Dal Lago

VP Global Expansion

Tether

Marieke Flament [Moderator]

Co-Author

Euro Stable Watch

The Future of Blockchain Financing - Reimagining Capital Formation for the Real Economy

Global experts explore how blockchain and tokenization are redefining capital formation and project financing - bringing transparency, efficiency, and new liquidity to the real economy. The session highlights Abu Dhabi’s potential to emerge as a global hub for RWA and project financing, empowered by its innovation-friendly regulatory environment

Emil Woods

Founding Partner

Liberty City Ventures

Omer Khan

Chief Technology Officer

Kresus Labs Inc.

Young Kim

CEO

Ara Investment Partners

Ben Lakoff [Moderator]

Managing Partner

Bankless VC

From Protocol to Platform: Reimagining Blockchains

Blockchain is no longer just about transfers, it’s about transformation. This keynote unpacks how today’s most advanced networks are moving beyond base-layer protocols to become platforms for real financial innovation. Think tokenized assets, faster rails, smarter contracts and the tools that turn infrastructure into impact.

John Nahas

Chief Business Officer

Ava Labs

Have We Finished Building the Bridge?

From disruption to deployment, blockchain has reshaped how finance thinks about value, trust and technology. Yet as regulation, infrastructure and liquidity mature, the question remains: have we truly connected decentralised innovation with the financial systems it set out to transform, or is the bridge still under construction? Voices from the foundation, framework and flow side of the ecosystem deliver their verdict and debate what it will take to finally complete the connection.

Adrian Wall

Senior Director of U.S. Policy, TRON DAO and Managing Director

Digital Sovereignty Alliance (DSA)

Demetrios Skalkotos

Chief DeFi and Protocols Officer

Blockdaemon

Omer Husain

General Manager, Bitcoin DeFi

Input | Output

Nilixa Devlukia [Moderator]

Senior Advisor

Global Counsel

H.E. Rashed Abdulkarim Al Blooshi

CEO

ADGM Registration Authority

Abu Dhabi in Action: Strengthening Market Integrity Across the Emirate

Market integrity is the foundation of innovation. In this conversation, regulators and industry leaders explore how Abu Dhabi is modernising its compliance frameworks, strengthening anti–money laundering and fraud-prevention measures, and leveraging technology to enhance oversight and accountability. Together, they examine how these efforts are reinforcing transparency, investor confidence, and sustainable growth across one of the world’s most forward-looking financial hubs.

Timothy Land

Executive Director

ADGM Registration Authority

H.E. Rabee Salmeen Alhajeri

Executive Director of Business Compliance

Abu Dhabi Registration Authority (ADRA), Abu Dhabi Department of Economic Development (ADDED)

Jehanzeb Awan [Moderator]

Founder & CEO

j. awan & partners

The Future of Stablecoins: From Safe Assets to Engines of Real-World Growth

Stablecoins have become one of the most important financial innovations of the last decade, but their next phase will be defined by utility, transparency, and real-world impact. This talk explores how stablecoins are evolving beyond passive reserves into instruments that can safely channel global capital toward productive activity—including the fast-growing private-credit markets of emerging economies. We'll explore what's driving this shift, and what it means for institutions seeking sustainable, risk-adjusted yield.

John O'Connor

CEO

RealFi

Criminal Code: Mapping the Cybercrime Economy

Cybercrime is now the backbone of a trillion-dollar illicit economy. From cyber-enabled money laundering to large-scale scams, criminals are exploiting digital tools to operate at industrial scale. Cyber-enabled money laundering now accounts for a significant portion of the staggering $2 trillion laundered globally and over $1 trillion is stolen by scammers each year. This session explores how cyber and financial crime are converging and what governments, industry, and international bodies must do to fight back.

Dickon Johnstone

CEO

Themis

Geoff White

Author

Journalist

Dr. Ebrahim Al Alkeem Al Zaabi

Director of National Risk & Policies Department

NAMLCTFC

Emily Sheffield [Moderator]

Founder

Dartmouth55 Advisory

Quantum Has Landed: What Would You Build First?

The age of quantum isn't coming, it's here. Encryption? Breakable. Simulations? Limitless. Infrastructure? Scrambling to catch up. In this future-facing panel, we ask a provocative question: if quantum capabilities were fully unlocked today, what would you build first? Join quantum pioneers as they explore what’s possible now, what financial systems must unlearn and what kind of world we're coding into existence, before someone else does it first.

Steve Suarez

CEO

HorizonX

Merouane Debbah

Professor

Khalifa University

Leandro Aolita

Chief Researcher

Technology Innovation Institute

Aalia Mehreen Ahmed [Moderator]

Features Editor

Entrepreneur Middle East

Cross-Border Confidence: Payments, Permissions and Global Compliance

As financial institutions scale across borders, the ability to navigate fragmented regulatory environments, manage third-party data risks and embed trust into operational infrastructure is now mission-critical. This session brings together infrastructure providers, compliance specialists and digital payment pioneers to explore how financial ecosystems can remain agile and resilient, even as scrutiny intensifies. From API-led payments and secure data frameworks to regulatory readiness and governance innovation, discover the behind-the-scenes building blocks enabling global trust at scale.

Najma Salman

Managing Director - Co-Head CEEMEA - Institutional Cash & Trade

Deutsche Bank

Chen Yu

President

YeePay

Humphrey Valenbreder

CEO

Partior

The Human Element: Managing Risk Beyond Technology

Despite billions spent on cybersecurity, a record rise in fraud and cybercrime continues and the weakest link isn’t code, it’s people. From misdirected payments to manipulated employees, human error remains the top driver of breaches across finance. This session explores how firms are rethinking risk strategies to account for the human factor like training, culture, accountability, especially in sectors and organisations most vulnerable to attack. Because when every click counts, resilience starts with behaviour.

Travis DeForge

Director of Cybersecurity

Abacus Group

Lake Dai

Founder & Managing Partner, Sancus Ventures

Adjunct Professor, Carnegie Mellon University

Andrew Reakes

Director - Financial Services Industry

Presight

Bill Murray

General Partner

TAU Capital

The Future of Trust: Identity Verification to Entity Centric Risk

Fraud prevention has outgrown transactional and based defenses. The next frontier is entity-centric risk, understanding the full digital footprint behind every user.In this session, we’ll explore how new detection and verification technologies connect device, behavioral, and cross-platform signals to define what truly constitutes an identity and their corresponding entity risk. This proactive approach not only stops fraud earlier but enables banks and fintechs to grow safely and confidently, because real growth begins with trust.

Soups Ranjan

CEO

Sardine

Richard Mico

Chief Legal Officer & Head of Risk and Compliance

Lean Technologies

Jo Jeyaseelan

Head of Fraud Risk

Wio Bank

Abdallah Abu-Sheikh

CEO & Founder

Mal

Jon de Jager [Moderator]

Former Global CEO

CT Group

Insurance 4.0. What to Do and What to Stop

Insurance is going data first. The next win is one shared record of risk. This session sets out how Abu Dhabi, as it builds on its already growing market, can put in clean rails from day one. Capturing at source, keep a single record, connect the handoffs and avoid digitising legacy.

Tim Rayner

CEO, Specialty Business Solutions

Verisk

Five Real Risks We Face Tomorrow

Behind today’s headlines are systemic risks that most of the market continues to underestimate, or ignore entirely. In this sharp, forward-looking address, a leading mind on financial systems and regulatory design outlines five structural threats that demand urgent attention from both policymakers and private actors. With a track record of influencing global regulation, advising governments and drafting policy frameworks, he reveals the hidden vulnerabilities that could define tomorrow’s market landscape and what must be done now to mitigate them.

Barnabas Reynolds

Partner

Sullivan & Cromwell

Digital Infrastructure 2030: Convergence of AI, Web3, and Real-World Systems

By 2030, the boundaries between artificial intelligence, decentralised networks, and real-world systems will blur. AI will not only act as a tool but as an active participant–trading, creating, and governing within digital infrastructures. Web3 promises trustless coordination, yet what happens when algorithms, not humans, are the primary agents on these networks? This session will challenge leaders to imagine futures where identity, creativity, responsibility, and value are redefined by the convergence of AI and Web3. Together, we will explore what digital infrastructure humanity should build to safeguard dignity and resilience while embracing unprecedented opportunities. This ADGM-led session examines the regulatory and infrastructure challenges at the intersection of artificial intelligence, blockchain protocols, and tokenised real-world assets. Participants will identify gaps in current frameworks and propose collaborative approaches to support institutional adoption whilst safeguarding market integrity.

Institutional Bridges: Institutional Adoption and the Evolution of Digital Asset Regulation

Institutional adoption of digital assets is no longer a question of if but how. Regulators, central banks, and financial institutions are under pressure to balance innovation with stability while new forms of money–stablecoins, CBDCs, tokenized deposits–are vying to become the backbone of the next global settlement layer. This session will explore the institutional bridges needed to move from experimentation to real-world scale: regulatory frameworks that encourage responsible growth, infrastructure that can integrate with legacy systems, and cultural shifts within finance that embrace decentralization without losing trust. Participants will discuss how regulatory innovation can unlock the next phase of adoption and what shape the future financial architecture will take. This Hashed-led session explores practical pathways for institutional capital to enter digital asset markets, examining regulatory clarity requirements, custody solutions, and cross-border frameworks. Participants from traditional finance and blockchain infrastructure will map near-term opportunities for regulated institutional participation.

StableCoin Dialogues

The AI Evolution: From Potential to Practicality with Bloomberg

AI is changing the financial industry — and the world around us — at an accelerating pace. This roundtable will explore how AI is becoming a foundational technology in building more connected, efficient, and resilient financial systems, from capital flows and risk management to optimisation and market intelligence. Focusing on the challenges of enterprise AI adoption and insights on some of its most promising applications across finance.

K-Night by Hanwha

Capital Vibes

Opening Remarks

Opening Remarks  Keynote

Keynote  Fireside

Fireside  Panel

Panel

Presentation

Presentation  Pitching Session

Pitching Session  Ceremony

Ceremony

Welcome

Welcome  Spotlight

Spotlight

Roundtable

Roundtable

Social

Social